Information for Fiduciaries and other Responsible Parties

Welcome to ERGF’s page for Fiduciaries and other responsible parties. We often work with Trustees, Executors, Attorneys, Financial and Tax Professionals, and other parties who are ultimately responsible for the best interest of somebody else. Here, you will find a brief overview about ERGF and what we do, some FAQs, and Contact information in the event you have more questions or would prefer to talk in real time.

Brief Overview of ERGF

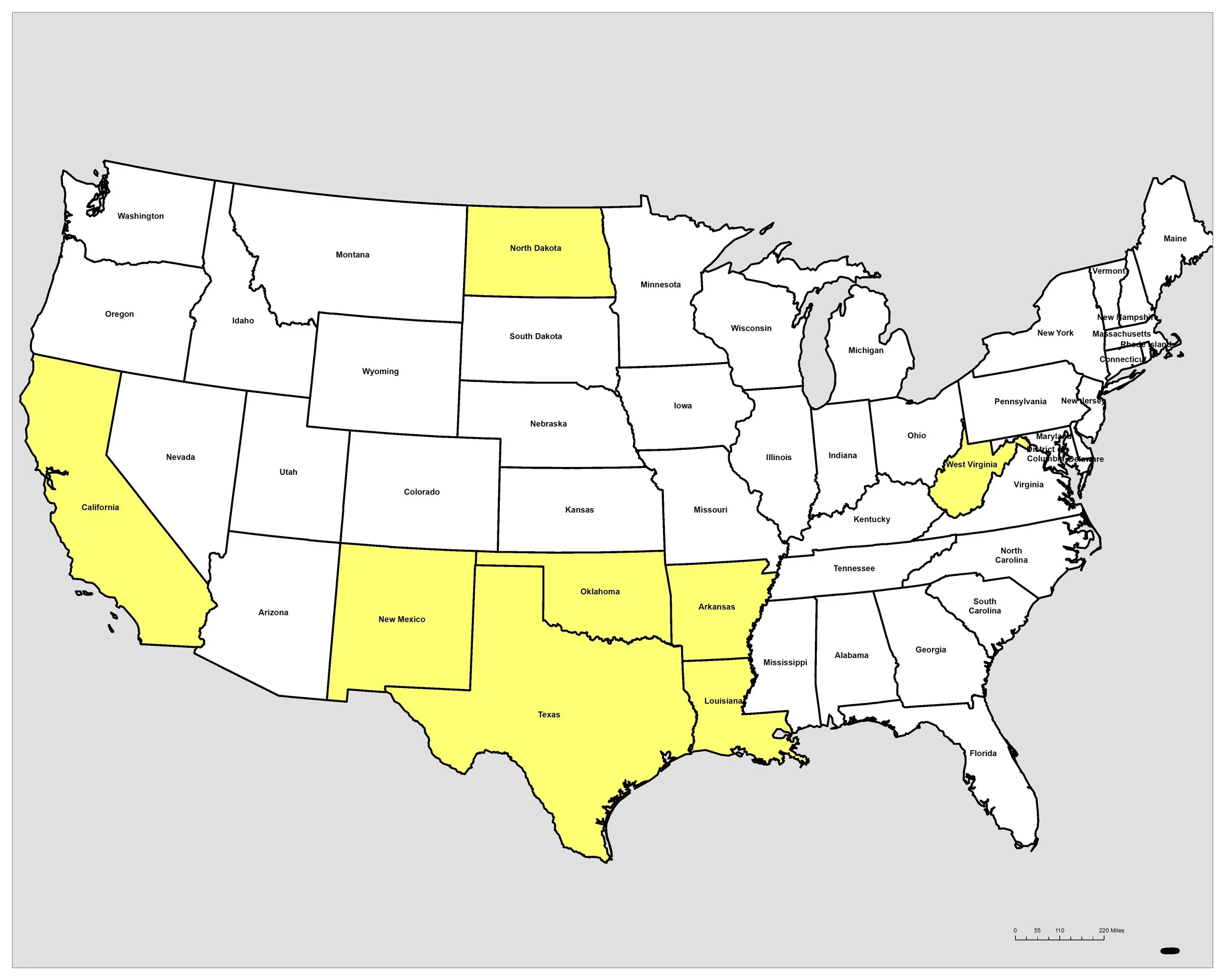

Earth Resource Guardian Foundation (ERGF) was created in 2021 and is an IRS 501(c)(3) non-profit organization. Our primary focus is on the responsible stewardship of oil and gas mineral resources in the United States. Today, we currently oversee over 60,000 estimated gross acres of mineral and royalty rights across 8 states.

Frequently Asked Questions

-

We manage and safeguard donated mineral rights. We negotiate lease terms with environmental protections. We produce educational materials for land and mineral owners. We conduct site visits of oil and gas well sites to look for signs of pollution.

-

A donation may make more sense from a tax standpoint, though every situation is different.

Selling requires you, as fiduciary, to market and find the best buyer out there. Many buyers are just flipping minerals and will hook you with a price, but then vanish if they can’t find somebody willing to pay more. Is your Buyer legitimate? Are you getting a good price?

A sale may trigger capital gains tax, which could potentially be avoided with a donation.

With a sale, your Client’s legacy in the minerals disappears forever. Many times, the minerals are inherited and there is some sentimental part to it. With a donation, their legacy lives on. We do not sell anything we own.

-

Donating minerals offers the benefit of reducing administrative burdens.

Oil and Gas companies constantly trade properties. Keeping track of who should be paying, if payments are correct, etc., is time consuming.

Annual 1099 reporting and verifying accuracy of reported information.

Annual County property taxes.

Federal tax depletion allowances.

-

Many non-profits own mineral interests. Typically, they only view them as an income source to fund their other programs and that’s it.

We are one of the only non-profit organization where the donated mineral rights are directly related to our primary purpose…the stewardship of oil and gas properties to ensure their responsible development.

To us, the minerals are much more than just an income stream, and we welcome non-producing properties as well.

-

Easy as 1-2-3.

Seeking an IRS charitable donation deduction? If valued over $5,000, the minerals must be appraised by an independent third party. We can refer you to one, but cannot pay for it. You will need to prepare IRS Form 8283, which we will acknowledge after the appraisal. If not seeking a deduction, go to Step 2.

We will prepare a Deed that describes the minerals being donated. Your Client will have the Deed signed and notarized, then returned to us.

We will record the Deed in the County deed records where the minerals are located. A copy of the recorded deed will be sent to you for your records.

That’s it. From there, we will notify any oil and gas companies that are paying royalties, as well as the County taxing authority.

-

Typically, we pay the cost in preparing and recording the Deed in the county records. Recording fees vary by County and State. If the recording fees are unusually high and there is no income to be expected, we may ask for some financial assistance to help offset the cost of recording. But typically, as long as a property can pay back the recording fees within a few years, we consider it a win for us.

-

Mineral/Royalty interests

Non-Participating Royalty Interests (NPRI)

Overriding Royalty Interests (ORRI)

Term Interests (minerals or royalty rights, but for specified number of years)

Surface interests

The primary thing we do not accept are leasehold/working interests. These are rights in an oil lease itself, which typically bear a share of costs and liability in operating an oil and gas well.

-

No.

Our minerals are not for sale, nor do we respond to solicitations for purchase.

Unleased minerals may be leased for development if certain conditions are met. If other mineral owners in the tract have leased, we will lease the minerals since the oil company will drill regardless. However, our lease negotiations focus on environmental protections first, and pecuniary benefit second.

Our niche: We are a conservation organization, but we are not “Anti-Oil & Gas”. We believe fossil fuel production is a current reality, and will be for some time until alternative energies are more fully developed. We believe in domestic fossil fuel production, as the USA is the only major country where private individuals and organization can own and control mineral rights. Thus, we believe in being a steward over these resources to ensure they are produced responsibly, and we believe companies can still be profitable while doing better for our environment.

Our Programs: We have four core programs. You can learn about them more here. ERGF’s primary program focuses on the stewardship and management of oil and gas mineral rights. We currently safeguard mineral interests in 8 states spanning over 19,500 gross acres.

Our Partners: We do not have formal partnerships or receive grant funding. We started as a grassroots organization, and still maintain many of those principles. Our partners are our donors. For the most part, individuals looking to donate minerals and leave a legacy. But we often work with Trusts, Estates, Partnerships, and other groups that believe donating minerals are in their Client’s best interest.

Contact Us

Phone: 817-717-5452

Email: Info@ERGF.org

Mail: P.O. Box 1172, Aledo, Texas 76008

ERGF is a proud steward of mineral rights in 8 states, spanning an estimated 19,500 gross acres.